Australia’s wealthiest 200 revealed, fortunes blow past $667b

Article by Yolanda Redrup, courtesy of Financial Review

30.05.2025

It’s been a year of mixed fortunes. Retailer margins have been squeezed, equities investors have been on a roller coaster and coal prices have softened, and yet the country’s 200 largest fortunes have collectively leapt 6.9 per cent to $667.8 billion.

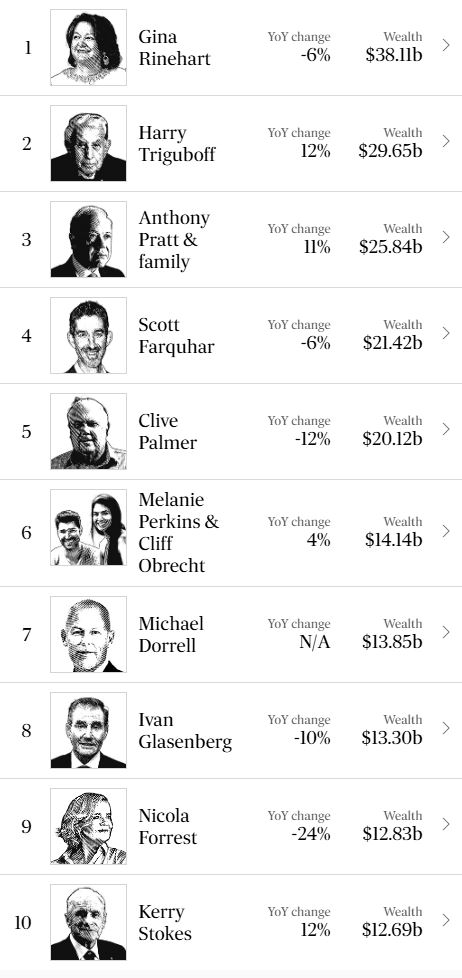

Topping the Financial Review Rich List for the sixth year in a row is iron ore queen Gina Rinehart, with an estimated net worth of $38.1 billion. Her dominance is matched by that of the resources sector, which continues to be the largest industry by value (worth more than $141 billion) represented on the Rich List. Miners increased their total wealth in 2025, even though key players have gone backwards.

Rinehart’s father, Lang Hancock, appeared on the inaugural Rich List, and the family have been a mainstay ever since. But when asked what her most memorable investment has been, she told The Australian Financial Review it was not one that yielded her a profit, rather it was financial aid she had given to young girls in Cambodia.

“One of these special girls’ dads died of AIDS when she was two … she lived in a type of humpy which, when it rained a lot, the mud flowed through, and they had to sit up at nights huddled together as the mud flowed,” Rinehart says. “No electricity, no running water, no bathroom, kitchen or laundry.

“This girl from such poor and terrible beginnings, and others I have had the joy of helping with education, accommodation … daily adequate food, transport, medical and more, is now the recipient of two degrees, and happily married; a kind, very polite, considerate, ladylike young lady, who you could take anywhere and who any mother would be very, very proud of. A true role model.”

Harry Triguboff (No. 2) and Frank Lowy (No. 16). Chris Andrew

Rinehart lost 6 per cent of her net worth in 2025, former Glencore chief executive officer Ivan Glasenberg’s net worth declined by 10 per cent and Andrew and Nicola Forrest slipped 24 per cent each. At the lower end of the list, Mineral Resources’ embattled founder, Chris Ellison, tumbled an astounding 59 per cent on the back of his corporate governance and tax scandals.

These losses, however, were made up for by the addition of two debutants in M Resources’ Matt Latimore and Phoenix Lithium CEO Nick Wakim, along with valuation surges for Sam Chong and Perth sisters Alexandra Burt and Leonie Baldock. Chong bought out Anglo American’s stake in his family’s Jellinbah Group in November. Burt and Baldock had an unexpected payday when Japanese giant Mitsui agreed to pay $US3.2 billion ($5 billion) for their company VOC Group’s 25 per cent stake in Rio Tinto’s Rhodes Ridge iron ore project.

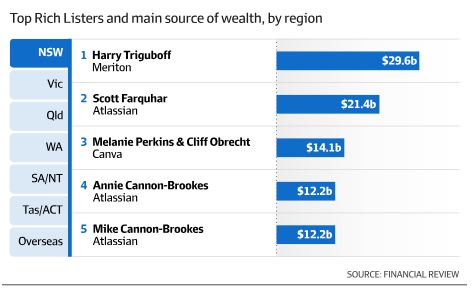

Property, once again, is the second-largest sector, contributing $125.8 billion. Meriton founder Harry Triguboff held on to second place on this year’s Rich List, his valuation jumping 12 per cent to $29.7 billion. Meriton enjoyed a good financial year in 2024; its revenue climbing to $1.62 billion, up from $1.47 billion the year earlier.

The gap between property and tech widened this year; the technologists are worth a collective $105.9 billion. This gap would have significantly narrowed, however, had this year’s valuation cut-off of mid-April not fallen in the middle of the equities markets freefall triggered by US President Donald Trump’s aggressive tariffs.

Most Rich Lister tech fortunes are linked to listed share prices – Atlassian, WiseTech Global, Pro Medicus, Objective Corp, Macquarie Technology Group, to name a few – while much of the property sector wealth captured by the list is tied up in private companies. It’s little wonder property is the most prevalent investment class of the richest people in the country – it’s as safe as houses.

But when measured more broadly, tech is only slightly behind property as the second-largest source of wealth. Airwallex is both a tech firm and a payments company; we’ve elected to put its founder Jack Zhang in the finance category. The same treatment has been given to Computershare founder Chris Morris.

Likewise, online gambling players Tim Heath, Ed Craven and Laurence Escalante are all classified in “Media and gaming” this year. If these fortunes were added to the tech total, it would nearly equal the property sector and hit $123.3 billion. The tech sector’s growth has been rapid. In 2020, it contributed just $54.67 billion to the collective total of the top 200.

Many regular Australians banked fewer savings in the past 12 months due to years of above-average inflation. Cost-of-living pressures also show up in the Rich List, in the form of tighter profit margins for retailers. Most retailers increased revenue, but few lifted net profit because the cost of producing their wares increased.

This resulted in small valuation trims for many, including veteran Solomon Lew and sisters Nicky and Simone Zimmermann. Also marked down was Neville Crichton, whose auto parts import and distribution business suffered a 21 per cent revenue slide and a swing from a $107.3 million profit to a $10.6 million loss.

These reductions, however, were more than offset by the significant valuation expansion enjoyed in the year’s most exciting Rich Lister story – the merger of Chemist Warehouse with Sigma, creating a $35 billion ASX-listed pharmacy giant. The event resulted in three new names being added to the Gance and Verrocchi family entries – twin brothers Marcello Verrocchi and Adrian Verrocchi, and a director of the merged companies, Damien Gance (son of Sam Gance).

Marcello Verrocchi (left) and Mario Verrocchi (No. 17). Chris Andrew

Each would have qualified for the Rich List in their own right but were, maintaining convention, added to their respective family valuations given the wealth is predominantly generated from the same business. Consequently, the Gance family are now worth an estimated $11.3 billion, while the Verrocchi family fortune soared to a $9.8 billion.

Female representation on the list increased slightly this year to 42, up from 41 in 2024. New names include Gail Fletcher, who was added to husband Roger’s listing in recognition of her 10 per cent ownership and role in expanding their meat processing and exportation business.

Of 10 debutants on this year’s Rich List, only one is a woman – Margaret Dymond, owner of automotive products business Penrite. Annie Cannon-Brookes, the estranged wife of Atlassian co-founder Mike Cannon-Brookes, was featured for the first time as part of a combined entry in 2024, but this year appears on her own. The Rich List team felt it was prudent to split the former pair’s valuation 50/50, now that their divorce appears to be proceeding.

In February, Cannon-Brookes sued his former company secretary for secretly emailing confidential information about his private companies to Annie. She has also set up her own private family office.

The most remarkable debutant on this year’s list is Stonepeak co-founder Michael Dorrell. Somehow, the fund manager stayed off the Rich List’s radar while amassing a $13.9 billion fortune. He rockets into seventh spot on the list.

A notable drop in wealth was marked by our new valuation for the family of Terry Snow. The Canberra Airport founder died in August last year and a representative of the family explained during our research process that more than half of his estate was being given to a charitable trust. As a result, their wealth goes from $4.1 billion to $1.5 billion.

With the average age of Rich Listers now around 70, perhaps more fortunes will reduce as wealth is given away. Indeed, charitable giving is the only thing that could slow the rapid wealth accumulation of the richest Australians. New analysis by economist Reuben Finighan of all historical lists between 1983 and 2024, in real, inflation-adjusted terms, reveals the wealth of the top 200 grew 26 times faster than per capita income and 7.7 times faster than per capita wealth in the same period. The top 15 Rich Listers are also increasing their wealth quicker than the rest. The rich not only get richer, they increase their wealth faster.