Rinehart’s rare earths portfolio triples to $2.69bn amid Western supply push

Article by Isabel Vieira, courtesy of the Australian

28.08.2025

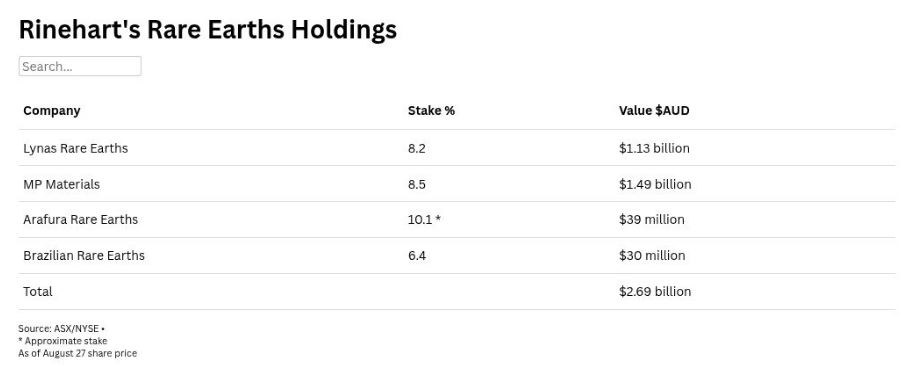

The value of Gina Rinehart’s rare earths portfolio has more than tripled to about $2.69 billion on a share price rally since the sector was upended and governments intervened to break China’s stronghold.

The rocket under rare earths stocks in the past four months has bolstered the value of Australia’s richest person’s collective holdings from about $800 million to $2.69 billion today.

The rally came off the back of China – which has the monopoly on rare earths production and processing – imposing export restrictions on heavy rare earths terbium and dysprosium in response to US tariffs introduced in April.

The flow of rare earth products dried up and exposed the fragility of supply chains, prompting the Pentagon to intervene the Australian government to follow suit in an effort to buoy a local industry and secure non-China supply.

In April 2024, Mrs Rinehart went on her rare earths shopping spree and picked up stakes in WA miner Lynas Rare Earths, which processes in Malaysia, and California-based MP Materials – the only two producers outside of China.

She’s since upped both those stakes, with the Lynas foothold having swelled to $1.13 billion at today’s close of $14.73 per share.

Mrs Rinehart, either directly or through her private mining vehicle Hancock Prospecting, also bought into both ASX-listed Arafura Rare Earths and Brazilian Rare Earths.

Hancock participated in Arafura’s recent raise but opted to sit out of lithium miner Liontown Resources’ raising while the federal government chipped in. Aside from her lucrative iron ore business, Mrs Rinehart’s investments also span lithium, copper, and oil and gas.

Mrs Rinehart’s foray into rare earths was aligned with her public support of the Trump administration. She’s also vocal on defence matters, having called for the nation’s defence investment to be more than doubled to 5 per cent of GDP.

Rare earths elements have critical applications for advanced defence technologies, such as precision guidance systems in missiles and aircraft. The end product, rare earth magnets, are also used in renewable technologies and electric vehicles.

Mrs Rinehart now sits on the New York-listed MP Materials share register alongside the US Department of Defence after it made its landmark equity investment in the Mountain Pass mine producer.

Last month, the Pentagon invested $US400 million in MP Materials to secure its supply of rare earths, which gives it the ability to become the major shareholder.

It also set a floor price for the neodymium and praseodymium it’s prepared to buy at US$110/kg – about double the current rate of depressed prices, which are about $US60-70/kg.

Last year, Lynas and MP were in talks over a $10 billion merger but the deal came to nought after the companies failed to agree on terms. Mrs Rinehart would have a voice if consolidation was ever on the cards again.

The Australian government is also assessing options to shore up a local supply, including equity stakes, floor prices and offtake agreements, according to Federal Resources Minister Madeleine King.

In the hours after the US’s tariffs were announced, Prime Minister Anthony Albanese pledged to build a $1.2 billion critical minerals stockpile, for which a taskforce is underway consulting industry players.

The White House’s intervention and the Australian government’s push to solidify Western supply has also informed the recent share price gains of local developers.

Victory Metals, Northern Minerals, Iluka Resources and Australian Strategic Materials all recorded share price rallies in the past four months.

To date, Iluka has the strongest backing from the federal government to the tune of $1.65 billion of taxpayer dollars for the development of its Eneabba rare earths refinery.

Hancock was contacted for comment.